As you will know if you were paying attention to the news of travel giant Thomas Cook’s closure last week, times are tough for travel agents.

The rise of the internet, and the information and reservation capabilities of its users, have made it much harder for travel brokers to get their cut. Where their area of expertise was once an integral element of the booking process, high-street agents have been usurped by the likes of TripAdvisor, Booking.com and Skyscanner – allowing consumers to do their research and have a decent stab at booking a holiday that ticks all the boxes – without having to leave the house.

According to research on the subject, just 18% of Brits used a travel agent in 2017, and more than 350 high street agents shut up shop in the same year. While that figure is less pertinent to the agents operating in the luxury sector, even they are feeling the squeeze that comes from the world wide web.

However, unlike your budget travel agent, the luxury sector has found a way to hold its own – embracing cryptocurrency.

Blockchain Backstory

If you have been living under a rock in the past few years, it is possible that the boom of the cryptocurrency has passed you by. If so, here is a potted summary: Cryptocurrency is essentially a digital asset and medium of exchange, protected by complex features (called cryptography) that protects it from security breaches, corruption, or counterfeiting. By being digital, cryptocurrencies are decentralised and operate outside of the realms traditional governance, from banks or state governments.

Of course, this was an attractive proposition for investment tycoons – many of which had migrated from a similar market in gold, to chance their arm at some crypto trading. Broker review websites soon popped up, and by 2017 the market boomed – led primarily by the surge in the most ubiquitous of the currencies – bitcoin.

It was not long before bitcoin trading platforms had minted a number of overnight bitcoin billionaires. Sensing a changing of the guard, the luxury travel and transport sector immediately changed its approach to cater for the era of the newest kind of new money entrepreneurs.

Crypto Customs

A good number of travel heavyweights, including Expedia and TUI Group, cottoned on to the value of cryptocurrencies long before the bitcoin boom, though. A lot of it boils down to the mission statement of blockchain. To decentralise, improve efficiency of transactions, and, most importantly, increase security. In protecting the value of the asset through cryptography, digital currencies were doing quite a bit of the heavy lifting for the travel companies in the first place.

Operating internationally by their very nature, travel brands are always attempting to streamline the often-jarring process of offering, verifying, and eventually accepting consumers’ transactions from countries and fiat currencies from around the world. By accepting cryptocurrency payments, these companies were no longer caught up in the red tape and bureaucracy that comes from complying with dozens of laws between many continents. After all, a customer’s bitcoin (or dogecoin, Litecoin, or any other cryptocurrency) was worth the same amount in TUI’s German offices as it was in New Zealand, New Guinea or anywhere else – unlike the often-volatile nature of the international currency market.

The same can be said of other big-ticket industries that operate across many territories, like exotic cars. In 2017, an early adopter of cryptocurrency, Peter Saddington, broke the internet when he cashed in his 45 bitcoin for a Lamborghini Huracan.

The story was made all the more interesting due to the timing of Saddington’s bitcoin purchase. As a coder, with a keen interest in crypto, the 35-year-old purchased his 45 bitcoin for the equivalent of $115 (USD). By the time he had exchanged it for the Lamborghini, it was worth $200,000.

Scratching the Surface

Like with anything in the free market, if the consumer base is there, companies will adapt to provide goods and services to it. Outside of exotic cars and travel agents, a number of cryptocurrency concierge services are beginning to pop up, catering to the blockchain backpacker.

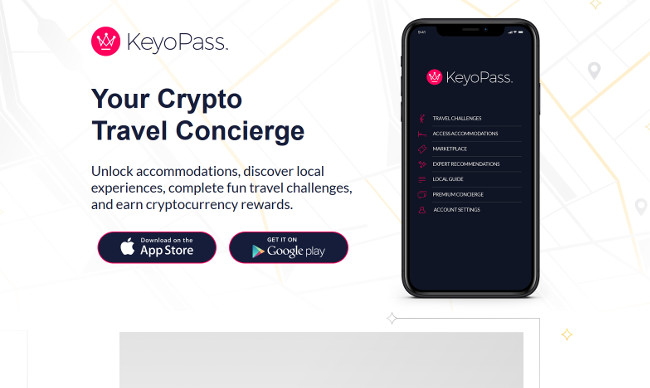

One notable example of this is KeyoPass, an app that specialises in providing bespoke and personalised luxury travel itineraries for the cryptocurrency user. Operated via the easy to use mobile app, KeyoPass tracks your location, hooks you up with a local expert, and offers you exclusive and personalised suggestions based on your preferences.

It even offers the opportunity to earn cryptocurrency rewards by participating in local ‘challenges’ – helping to fund the next adventure.

You can be sure that, in an emerging market such as this cryptocurrency, the luxury travel industry will continue to find ways to get on board.

While the sun might have set on the high street travel agent, the blockchain travel revolution is just dawning.

Investing in cryptocurrencies carries risk, do so at your own risk and we advise people to never invest more money than they can afford to lose and to seek professional advice before doing so.